The Greatest Guide To Medicare Agent Huntington Ny

Wiki Article

The 8-Second Trick For Medicare Agent Huntington Ny

Table of ContentsEverything about Medicare Agent Huntington NyOur Medicare Agent Huntington Ny PDFsHow Medicare Agent Huntington Ny can Save You Time, Stress, and Money.The Best Guide To Medicare Agent Huntington Ny

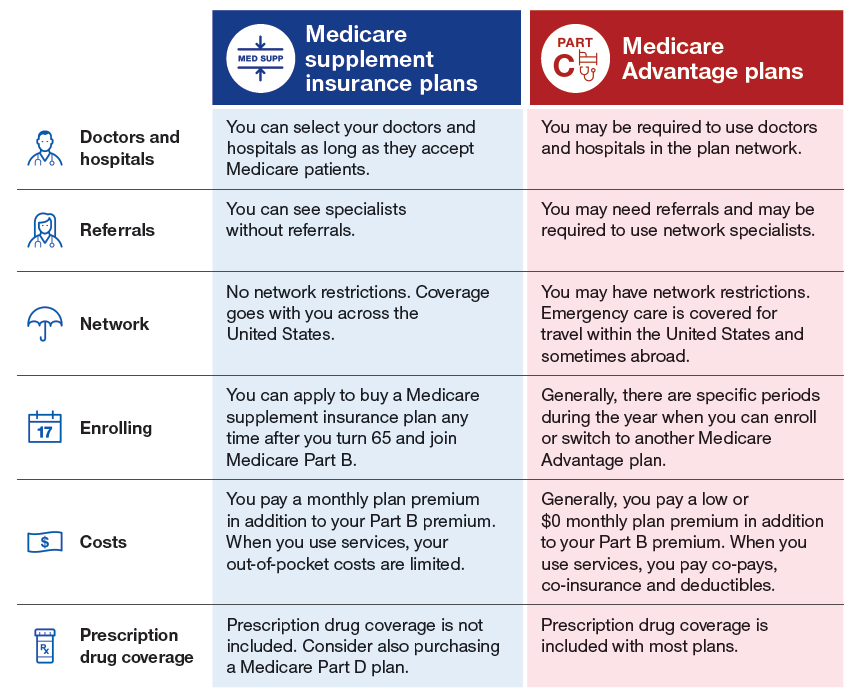

Browsing Medicare can be frustrating, also if you have actually purchased your own wellness insurance in the past. You have a number of alternatives to select from, consisting of Original Medicare, Medicare Advantage and Medicare Supplement Insurance Policy. It takes some job to find out which sort of Medicare is right for you, in addition to which plan covers whatever you require.That's where a Medicare agent or broker can aid. These are accredited experts that can enlighten you regarding Medicare and also assist you sign up in a plan.

A certified Medicare representative, in some cases described as a broker, partners with medical insurance business to assist you sign up in a Medicare plan. To get certified, a Medicare agent need to understand the ins as well as outs of Medicare, have the ability to contrast strategies, discuss advantages and also identify eligibility. Typically, there is no cost to deal with a Medicare broker.

There is never any responsibility to register in a plan even if an agent has actually aided you. Medicare agents can provide information about the Medicare plans readily available to you. You not only have numerous sorts of Medicare readily available to you, like Original Medicare, Medicare Benefit and also Medicare Supplement, however you additionally have a big choice of different strategies to select from.

Fascination About Medicare Agent Huntington Ny

They'll ask about your: Health needs Spending plan Preferred medical professionals Medications With this details, they can provide you with strategy options that check all the boxes. As soon as you make a decision on a strategy, a Medicare agent will certainly after that stroll you with the registration process and make sure that your application obtains sent to the wellness insurance business for testimonial.The objective is to make you really feel confident in your Medicare decision. At Quote, Wizard, we have a team of licensed and also experienced Medicare representatives readily available to help you.

They can damage down the kinds of Medicare protection as well as clarify the benefits and drawbacks of each. From there, they can stroll you with the strategies offered in your location and also explain the benefits in detail.: We deal with the leading medical insurance business in the nation, whereas some Medicare brokers only work with a couple of.

With more options to select from, you're most likely to locate a strategy that's within your spending plan and also meets your medical needs.: If you decide to register in a Medicare Supplement plan (also called Medigap) as well as you're not in your Initial Enrollment Period (IEP), you may be required to go through medical underwriting.

More About Medicare Agent Huntington Ny

: Once you have actually determined on a strategy, our additional info Medicare agents will aid you finish the enrollment application. They will certainly stroll you via each area and see to it that it's exact and full. From there, it will be sent out to the wellness insurance coverage firm for testimonial. If you would such as to deal with a Quote, Wizard agent, simply call (855) 906-0601.Quote, Wizard. com LLC has actually striven to make certain that the information on this website is correct, however we can not ensure that it is devoid of mistakes, errors, or omissions. All content as well as solutions offered on or through this website are given "as is" as well as "as readily available" for use. Medicare agent Huntington NY.

com LLC makes no representations or service warranties of any kind, reveal or indicated, regarding the operation of this site or to the info, content, products, or items included on this site. You specifically concur that your use this site is at your sole threat.

Certified representatives (likewise referred to as brokers) and companies can aid Medicare recipients pick the ideal protection. Agents are people that are licensed and registered to obtain and also register people into insurance coverage products. Medicare agent Huntington NY. Agencies offer administrative assistance such as marketing, technology infrastructure, compliance, and other solutions for representatives. Medicare prepares agreement with representatives as well as my company agencies to get to and also enroll recipients; in return, representatives make payments straight from insurance firms.

Medicare Agent Huntington Ny Can Be Fun For Everyone

For standalone Component D plans, the 2022 maximum nationwide commission for new registration is $87 and does not vary by region - Medicare agent Huntington NY. These payments are paid when the recipient first enrolls in an MA or Component D strategy. Once a beneficiary is enlisted in an MA or Component D strategy, agents gain a payment when the beneficiary switches to a new plan or stays with the initial strategy.

CMS optimum payment prices are set lower for "switchers" as well as "renewals" 50 percent of the first-time commission. For Part D, the nationwide maximum revival compensation is $44.

Report this wiki page